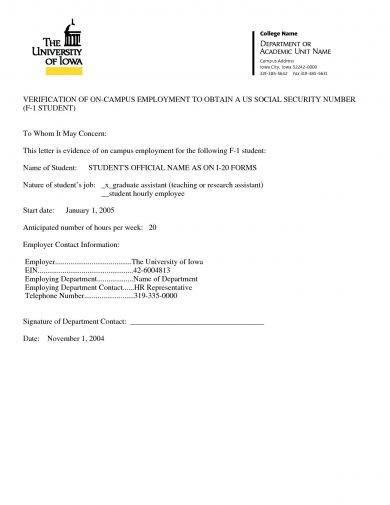

If you are the parent of a dependent student or are an independent student,submit an IRS Verification of Nonfiling Letter. The federal government now requires independent students and the parents of dependent students who filed a FAFSA to have the IRS verify if no tax return was filed. For more information on nonfiling letters, see the IRS Transcript Types Web page. This statement is for independent students, student's spouse, or parents of dependent students who did not file and are not required to file an income tax return for the applicable tax year. Upon completing the form, you must sign, date AND attach a copy of IRS Form W-2 or an equivalent document for each source of 2018 employment income received by the individual.

As part of the new verification process for financial aid, it is required that independent students and parents of dependent students who do not file taxes submit an IRS letter of non-filing status to the University. A non-filing letter will be necessary for all parents/adult contributors to the custodial household that did not file taxes. If you are the parent of a dependent student, or are an independent student, who did not file a 2019 tax return, request to have a Verification of Nonfiling Letter mailed directly to you. The letter provides confirmation that the IRS has no record of your filing a tax return for the year requested. You can order a Verification of Nonfiling Letter on the IRS Web site or by submitting Form 4506-T to the IRS. After you receive your verification letter, submit it using our Online Document Upload Tool, or fax or mail it to the Undergraduate Financial Aid Office.

If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-filing letter a the address provided on their request within 5 to 10 days. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-filing letter at the address provided on their request within 5 to 10 days. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Nonfiling letter at the address provided on their request within 5 to 10 days. If you did NOT file a 2019 federal tax return, you must provide an IRS Verification of Non-filing Letter.The letter is required of each parent listed on the FAFSA of dependent students.

For independent students , only the student must provide this letter. The U.S. Department of Education selects approximately 30% of all aid applicants for verification. The Catholic University of America selects an additional percentage of first-time undergraduate students for federal and institutional verification. During the verification process the student and parent will be required to submit documentation for the amounts listed on the financial aid application. The verification process ensures that eligible students receive all the financial aid they are entitled to receive and prevents ineligible students from receiving aid they are not entitled to receive.

If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-Filing Letter at the address provided on their request within 5 to 10 days. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided on their request within 5 to 10 days. If you were selected for the Verification Process, you are required to provide tax documentation if you worked and filed a 2019 federal tax return. Parents and Independent students that worked but were not required to file a tax return must provide an "IRS Verification of Non-Filing Letter". Please remember that Verification of Non-filing Letters only apply to parents and independent students.

Dependent students whose FAFSAs were selected for verification and who did not file a tax return only need to complete the non-filer statement; they do not need to verify their non-filing status. The verification of non-filing letter confirms that you did not file a federal income tax return. You can obtain an electronic copy of the verification letter from the IRS using the online Get Transcript tool.

Any version of IRS Form is acceptable, as long as it contains a clear indication that it is provided as a verification of nonfiling or that the IRS has no record of a tax return for the tax year. If the individual did not properly or accurately complete his request for an IRS Verification of Nonfiling Letter or other IRS document, Form may be used by the IRS to communicate this to the individual. Such a communication is not acceptable for verification if it does not clearly indicate the IRS has no tax return on file. Such individuals should re-request the IRS Verification of Nonfiling Letter by properly following IRS document request procedures (for example, a properly completed 4506-T). Tax filers must follow prompts to enter their social security number and the numbers in their street address. Generally this will be numbers of the street address that was listed on the latest tax return filed.

However, if an address change has been completed through the US Postal Service, the IRS may have the updated address on file. The tax filers must sign and date the form and enter their telephone number. Only one signature is required to request a transcript for a joint return. If you have never filed taxes, you need to request by paper using the 4506-T form. If successfully validated, non filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in their telephone request within 5 to 10 days from the time of request.

If successfully validated, non filers can expect to receive a paper IRS Verification of Non-filing Letter at the address included in your online request within 5 to 10 days. As part of the new verification process for financial aid, it is required that people who do not file taxes submit an IRS letter of non-filing status to the SUNY Potsdam Financial Aid Office. A non-filing letter will be necessary for all parties in the custodial household that did not file taxes.

Please allow up to 15 business days for your documentation to be reviewed. Additional documentation may be requested, and any form that is incomplete or provides discrepant information will require follow-up and delay processing. If we are unable to complete verification, we may be required to cancel any existing financial aid awards you might have received.

Your FAFSA indicates that your parent did not file a 2018 federal tax return. If this is correct please complete the form on this page and submit it to the Office of Student Financial Services at the address listed on the form. Your parent will also need to submit an IRS letter of non-filing and a wage transcript.

In addition to the signed statement, a resident of a foreign country could, but is not required to, also provide proof of that taxing authority's filing requirements. This might involve obtaining something directly from the taxing authority or providing information that may be available on the taxing authority's website. As such, the individual may provide either a website confirmation or a signed and dated statement indicating the country does not have a taxing authority.

As part of the Federal Verification process for financial aid, the Department of Education requires thatindividuals who do not file taxessubmit an IRS letter of nonfiling status to the University. A nonfiling letter will be necessary for Parent 1 and Parent 2 in the custodial household that did not file taxes. Enter the non filer's Social Security Number , e-mail address, filing status, account numbers for loan or credit card associated with your name, and mobile phone associate with your name. This information will be used to verify your identity with the IRS. Per federal regulations copies of tax returns cannot be accepted to verify tax information.

You must provide copies of your and/or your parent 2015 tax return transcript obtained from the IRS. There are three ways to request the tax return transcript from the IRS. If you're currently in the college financial aid process, you may be selected for Verification, a process that requires you to submit tax documentation to college financial aid offices. If you didn't file taxes, you may need to submit documentation confirming that you have no taxes on file with the IRS. We've outlined here the key information needed to get you through the process seamlessly.

Your FAFSA indicates that you did not file a 2018 federal tax return. If this is correct please complete the form on this page based on the campus you are attending and submit it to the Office of Student Financial Services at the address listed on the form. You will also need to submit an IRS letter of non-filing and a wage transcript. If you filed a 2019 tax return but are unable to use IRS Data Retrieval, you must request a copy of your Tax Return Transcript from the IRS and submit the transcript as part of your financial aid application materials.

For more information on IRS transcripts, see the IRS Transcript Types Web page. You may be required to provide verification that you did not file a federal tax return as part of the federal verification process. Non-filing forms are for independent students and parents of dependent students who did not file taxes. Dependent students who do not file taxes are not required to complete a non-filing form per Department of Education regulations. If successfully validated, non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in the telephone request within 5 to 10 business days from the date of the request.

If your FAFSA is selected for a review process called verification, and you or your parent did not file taxes for the requested tax year, the U.S. Department of Education requires you to submit an IRS Verification of Non-filing Letter to your educational institution. If appropriate, a similar verification from another taxing authority (e.g., a U.S. territory or foreign government) is also acceptable.

Please contact our office for more information regarding verification of non-filing from other taxing authorities. The non-filers must sign and date the form and enter their telephone number. Mail or fax the completed IRS Form 4506-T to the appropriate address or FAX number. If you or your parents were not required to file a tax return, you must submit the 2019 IRS Verification of Non-filing letter.

Many students are selected for a process called verification by the Department of Education and are required to submit income information and other documents before they are eligible to receive a financial aid award. In response to a 4506-T, the IRS may send a version of Form if the 4506T was incomplete or inaccurate. If you filed a 2019 tax return but are ineligible to use IRS Data Retrieval, request a 2019 Tax Return Transcripton the IRS Web site or by submitting Form 4506-T to the IRS. After you receive your transcript, submit it using our Online Document Upload Tool, or fax or mail it to the Undergraduate Financial Aid Office.

Mail or fax the completed IRS Form to the appropriate address provided on page 2 of the form, based on where you lived at the time you filed your 2016 federal tax return. Note that a Verification of Nonfiling Letteris not available for request using the IRS toll-free phone number or the online Get Transcript By Mail service. The nonfiling letter can only be requested using the Get Transcript Online service or by mailing the 4506-T form to the IRS. Sign and date the letter and submit to the William & Mary financial aid office; be sure you put your student ID number (93#) on the letter.

Sign and date it and submit it to the William & Mary financial aid office. If successfully validated, non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in their telephone request within 5 to 10 days from the time of the request. If successfully validated, non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address included in their online request within 5 to 10 days. A signed statement indicating the person was not required to file taxes for that year by their tax authority and the name of the country where he/she resided.

Non-filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided in their telephone request within 5 to 10 days from the time of the request. Enter the non filer's Social Security Number , e-mail address, filing status, account numbers for loan or credit card associated with your name, and mobile phone associate with your name. Enter non filer's SSN, email address, filing status, account numbers of loan or credit card associated with your name, and phone number. If a login has already been created, continue by putting in your username.

If a login has not been created, click "get started and follow instructions to create a login. After enrolling for the first time, enter the address exactly as it appears on your tax return. If you, your spouse, or parents indicated on the electronic verification form that taxes were not filed, you will be asked to provide a non-filing letter from the IRS.

Use your Social Security Number, date of birth, and the mailing address from your latest tax return to request to have the letter mailed to you. The following are instructions for students who have never filed taxes to complete the IRS form 4506-T in order to request a Verification of Non-Filing letter from the IRS. IRS Form clearly stating that the form is provided as verification of nonfiling, or stating that the IRS has no record of a tax return for the individual for the tax year. Verification of Non-filing Letter- provides proof that the IRS has no record of a filed Form 1040, 1040A or 1040EZ for the year you requested. It doesn't indicate whether you were required to file a return for that year. The Verification of Non-filing letter provides proof that the IRS has no record of a filed Form 1040, 1040A or 1040EZ for the year you requested.

The non filer must sign and date the form and enter their telephone number. Only one signature is required when requesting a joint IRS Verification of Non-filing Letter. Submit a copy of the letter to the SUNY Potsdam financial aid office; be sure you put your Potsdam student ID number on the letter. Enter the nonfiler's Social Security Number, date of birth, street address, and zip or postal code. Enter the non-filer's Social Security Number, date of birth, street address, and zip or postal code.

Your VNF does not validate whether or not you were required to file taxes, but rather that you do not have a tax return on file with the IRS . If you can, we strongly encourage you to use this tool that allows parents and students to provide consent to the IRS to upload data from their federal tax returns at the time they complete the FAFSA. Form 4506-T is available on our Forms page, with the correct box checked off and our address and appropriate tax year filled in. If your FAFSA is selected for verification and you did not file a tax return, you will need to verify your income by completing our non-filer statement, found on the Forms page.

This option is typically not available if you have never filed taxes before in prior years. If this is the case, please use the paper request process detailed below. Please note if you filed a Puerto Rican or Foreign Income Tax return you must submit appropriate nonfiling documentation from a relevant tax authority. If you are unable to request this document online or by phone, please complete a 4506-T form to request it by mail. Please click herefor detailed instructions on how to complete IRS Form 4506-T to request a Verification of Non-filing Letter. Please make a copy, write your student ID number on the Verification of Non-filing Letter, and submit it to UofL's Student Financial Aid Office with your verification form via fax, mail, or in-person.

DO NOT email the verification form or verification of non-filing letter. Non-tax filers can request an IRS Verification of Non-filing Letter for their tax return status, free of charge. If you have a Verification form and you are an independent student or your parent included on your FAFSA did not file taxes in the requested tax year, please see the information below. For dependent students, instead of requiring a separate Statement of Non Tax Filer Status document from the IRS, this statement may be collected on the Dependent Verification Worksheet.

Please make sure the correct box is checked on the worksheet and all required signatures are on the form. Non-Tax filers can request an IRS Verification of Non-filing of their tax return status, free of charge, from the IRS. The non-filer must sign and date the form and enter their telephone number. Only one signature is required when requesting a joint IRS Verification of Non-Filing Letter. Non Tax filers can request an IRS Verification of Non-filing of their 2018 tax return status, free of charge, from the IRS.

An IRS Verification of Non-filing Letter provides proof that the IRS has no record of a filed Form 1040, 1040A or 1040EZ for the tax year requested. Non-tax filers can request an IRS Verification of Non-Filing from the IRS free of charge. This is typically not available if you have never filed taxes before in prior years. Please allow at least 7–10 business days after submitting your request for the documentation to arrive by mail from the IRS. For verification purposes, the verification of non-filing letter as well as IRS Forms 13873, T, or V are acceptable.