To help you get the most out of your IBC Bank online banking account, follow this demo that will walk you through the process of online banking from start to finish. Learn about the benefits of online banking, how to enroll, check account balances, view account activity, transfer funds, pay bills, deposit checks, set up account alerts and more. Remember you can also enjoy a fast convenient way to bank online from your smartphone device with the IBC Bank Mobile App. Thanks to online banking, you can manage your money anytime, almost anywhere. Use online bill pay to pay your monthly bills and Mobile Deposit to deposit checks using your mobile device's camera without having to add a trip to the bank.

Plus, access other online tools like digital payments, automatic savings and CreditWise. Just snap photos of the front and back of your check, enter the deposit amount, choose an account, and submit your deposit.|| It's never been easier—or safer—to bank from the comfort of your phone. You want more control of where and when you bank. Our online digital features and mobile banking app make it easier than ever to bank from anywhere.

You can check your balances, pay bills, transfer funds, set alerts, and more 24/7 from one place – your laptop, smartphone, or tablet. Online and mobile banking has just about everything you can do in a branch, without the branch. Sign on for 24/7 account access to check balances, pay bills, transfer money, even open new accounts. It's free and easy to use, our security is state-of-the-art and our 24/7 customer service is always available for whatever you need.

Altabank's mobile banking services use the same high security standards as our personal and business online banking services. Mobile banking uses 128-bit SSL encryption to protect your information, and we don't store any information on your phone. You are required to log in each time you access your account information or bill pay services through mobile banking. Mobile banking is available to existing online banking users only.

All terms applicable to online banking apply to mobile banking. With UMB Bank, personal banking is made easy with a suite of services from checking and savings accounts to credit services, investing and wealth management. We help you manage your money, meet your financial goals and finance your next big purchase. Our personal checking accounts and savings accounts are designed with your needs in mind, and we offer credit card and personal lending products with competitive rates. Online bill pay allows you to pay anyone, anywhere, anytime without writing or mailing a single check.

Simply log in to your Altabank online banking account to set up one-time or recurring online bill payments from any of your checking accounts. You can easily access your transaction history and pending payments anytime you want, as well as view images of cleared checks. You can quickly and securely deposit checks with Mobile Deposit using your smartphone or tablet. You'll also have access to your accounts to check balances, access your Fulton Bank Credit Card accounts, track recent transactions, and manage your money.

With Capital One online banking, you choose when, where and how to bank. You can access your account online or through the Capital One Mobile app. With built in security and 24/7 access, your money is always at your fingertips. Keep in mind, web access is needed to use mobile banking and Mobile Deposits are available only in the U.S. and U.S. Remember to check with your service provider for details on specific fees and charges.

Safe and secure, seamless and simple, Northwest Online Banking is designed for an easy and intuitive experience on any device. Transfer money and pay bills or use Zelle to safely send money to anyone instantly. Get a better view of your money with customized alerts and budgeting tools. Open a new account and apply for a loan—or check your credit score to see where you stand. Businesses in the Accelerated Rewards Tier have access to additional experiential rewards and a fixed point value airline travel reward.

In addition, purchases made using third-party payment accounts (services such as Venmo® and PayPal®, who also provide P2P payments) may not be eligible for cash back rewards. Apple, the Apple logo and Apple Pay are trademarks of Apple Inc., registered in the US and other countries. Venmo and PayPal are registered trademarks of PayPal, Inc.

In addition, purchases made using third-party payment accounts (services such as Venmo® and PayPal™, who also provide P2P payments) may not be eligible for cash back rewards. Apple, the Apple logo and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries. Use secure online and mobile banking to deposit checks, pay bills, send money to friends and more. Chase Bank serves nearly half of U.S. households with a broad range of products. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place.

To learn more, visit the Banking Education Center. For questions or concerns, please contact Chase customer service or let us know about Chase complaints and feedback. ¹ Transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic bank account or debit card. Recipients have 14 days to register to receive money or the transfer will be canceled.

Altabank offers electronic statements ("eStatements") for all of your personal and business accounts. The COVID-19 pandemic has led to an increase in online shopping and digital banking, offering more opportunities for bad actors to victimize consumers. A common method is the use of digital messages that appear to be from your bank instructing you to call a phone number to resolve an account issue. During the conversation, scammers will request login credentials to your online banking profile, obtaining access to your personal information and the ability transfer funds out of your account.

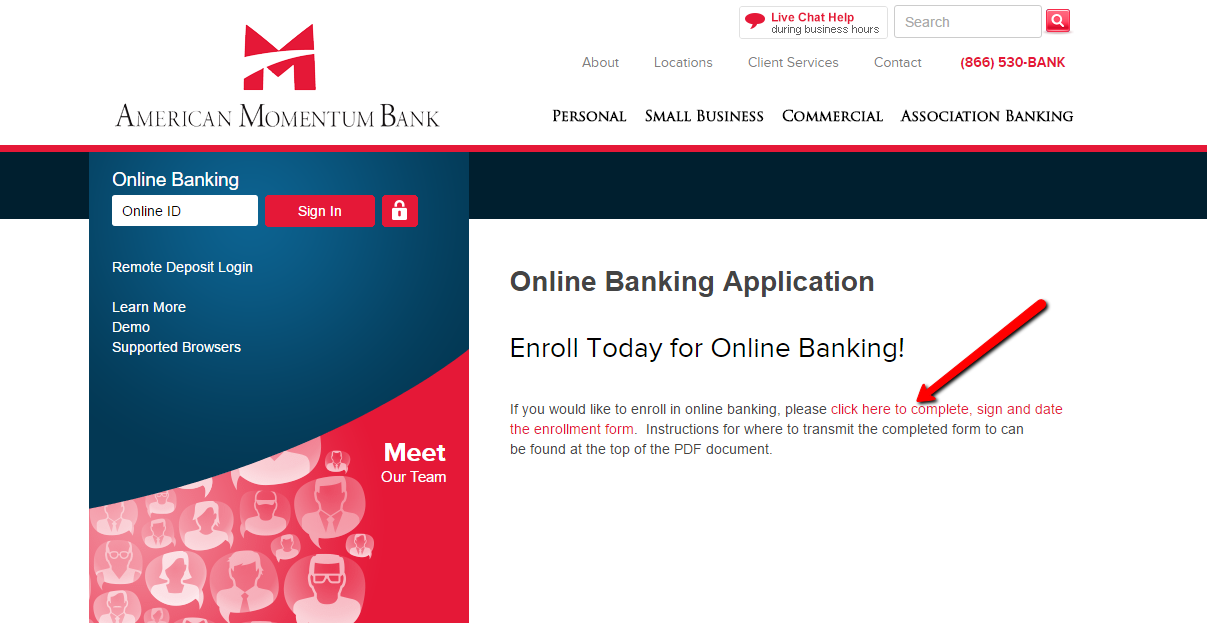

Enroll in Popular Online Banking to manage your finances whenever you wish. Review statements, pay bills, send and receive money, and transfer funds between multiple Popular Bank accounts. If you're enrolling in mobile and online banking to access your business accounts, you'll need an ATM or debit card. You can apply for these at a branch and use your PIN to log in to mobile or online banking.

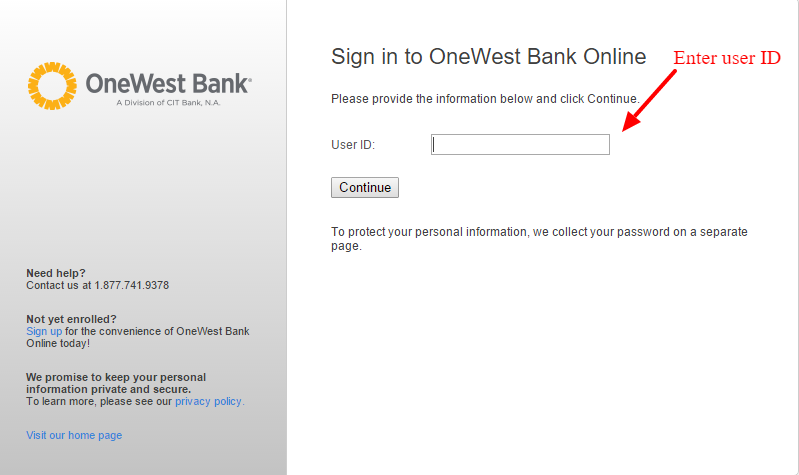

Next, create a unique username and password to log in securely in the future. Just follow the instructions on the enrollment page. Online and from the mobile app, it's easy to send and receive money between almost any U.S.-based bank accounts. Just enroll with your email or U.S. mobile number and you're ready to go. Managing your finances is easy with virtually 24-hour access to your accounts.

SunTrust Online Banking lets you view balances, transfer funds, pay bills, deposit checks and update your profile from anywhere—whenever it's convenient for you. Our online banking service gives you access to your accounts any time you need it. From checking your balance and viewing statements to paying bills and handling your overall finances, Cathay Bank makes accessing and managing your accounts easy and convenient. If you need your personal checking account to do more for your financial plan or to help your money work harder and fuel financial growth, UMB has a personal bank account that is right for you. Our personal savings accounts are designed with features and benefits that help you take the next step in your financial journey. Not sure which personal bank account is right for you?

Once you enroll in online banking, you can download the KeyBank mobile app on to your phone. You can also sign on to KeyBank online banking directly from key.com. Our online banking security uses advanced encryption and monitoring technology to ensure your money stays safe and secure. And to keep your personal information confidential, we have strict policies and procedures in place. Only you have access to your accounts with your username and password. We strongly suggest you do not share your username, password, PIN or account number with anyone.

We'll never request this type of information via email. Money Manager is an online money management tool that puts financial control back in your hands. Capital One works hard to keep you and your money secure and protected against fraud. All of Capital One's bank accounts provide online banking capabilities. Your account is also insured by the FDIC up to allowable limits.

Banking electronically provides a convenient, easy and secure way of accessing and managing your accounts at Bank of New Hampshire from the convenience of your home, your office or on the road! Banking services are at your fingertips with mobile apps that allow you to monitor your account activity, make a mobile deposit or transfer money to and from your accounts. You may redeem rewards dollars for account credits to be deposited to your First Citizens checking or savings account or applied to your First Citizens credit card, consumer loan or mortgage.

The redemptions will post within 2 to 8 business days. The redemptions will post within 2-8 business days. Businesses may redeem reward dollars for cash back to a First Citizens checking or savings account or credit card statement credits and Pay Me Back statement credits. In the interest of your online security, your account numbers will be masked for your protection. To help you identify your accounts, we suggest you use our Account Nickname feature.

If you pay bills, Bill Pay can save you time by eliminating bill preparation, check writing and even trips to the post office to mail your payments. You can pay bills quickly and easily using your PC or mobile device—without stamps or envelopes. Even better, funds for payments stay in your account until the payment clears the bank. Use Zelle® through online banking - it's a fast, easy, and secure way to send and receive money. Bank of Luxemburg offers convenient and secure Mobile Banking options, including the flexibility to set and manage email or text alerts! By setting alerts, you can receive helpful notifications if your balance falls below a specific dollar amount, a transfer fails or a password changes.

To get started on setting alerts for your account, watch administrative retail support's Jackie provide a detailed demonstration. While there have been many milestones over the last decade, today marks a true 'security step up' for online banking account sign-in and bank transfer protection for many Bank of America customers. Bank of America has announced that they are replacing SafePass with the new Secured Transfer feature, which allows for USB security key registration and transfer authentication with YubiKeys.

They have also provided the option for many Bank of America customers to sign-in to their online banking account with a USB security key. Easily access all of your United Bank personal accounts 24 hours a day. Check balances, transfer funds, review transaction history, place stop payments, order checks, and much more—anytime and from anywhere. Manage your bills the quick and paperless way with Bill Pay. You can also send and receive money with just a few clicks.

Not only can you make quick transfers between your bank accounts, you can transfer money between Bank of the West and other banks in the U.S. My IBC Bank Online is a smart solution for your personal and business banking needs. Discover the convenience of banking from anywhere, any time. Manage your finances with the click of a mouse or from your mobile device.

Download the mobile banking app to your Android device on the Android Market™ by searching for "Altabank." Log in using your existing online banking credentials. Download the mobile banking app to your iPhone or iPod Touch device on the iTunes Store℠ or on the iPhone App Store℠. Log in using your existing online banking credentials. Centennial Bank works with most major companies so you may enroll and receive electronic bills directly from Bill Payment. 2 Must have a bank account in the U.S. to use Zelle.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Payments can arrive as quickly as minutes or may take up to three business days. In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled in Zelle.

Enrolling is easy and should only take a few minutes. You'll just need your account number and Security Word. Login to check your accounts, transfer funds, pay bills and more. With online banking you can quickly & securely move funds within your account or to other America First accounts. You can also transfer money to external accounts. I thoroughly enjoy using the CommunityAmerica Banking App on my cell phone.

It's user friendly, allowing me access to view and keep track of my daily activities with my Checking, Savings and High Interest Savings accounts. It enables me to transfer funds between accounts and see what checks have cleared. Unlike some other apps I use for online accounts, my CommunityAmerica app is always available and easily accessible, making my online experience extremely enjoyable. Bank anytime, anywhere – deposit checks, pay bills, transfer money and more with our Online Banking options. If your password login credentials are stolen or compromised, you will still be protected because a physical YubiKey is required for 2FA.

Furthermore, once your YubiKey is linked to your account, it also serves as step-up security for adding transfer recipients to your account. Get alerts and access your account balances, transaction history and transfer funds on the go with Banner Bank's Text Banking — available with Banner Online Banking. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Must have a bank account in the U.S. to use Zelle.

It's important to only send money to people you trust, and always ensure you've used the correct email address or U.S. mobile number when sending money. With Business Banking, you'll receive guidance from a team of business professionals who specialize in helping improve cash flow, providing credit solutions, and on managing payroll. Chase also offers online and mobile services, business credit cards, and payment acceptance solutions built specifically for businesses. Choose the checking account that works best for you. See our Chase Total Checking®offer for new customers.

Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and 16,000 ATMs and more than 4,700 branches. Our Digital Security Guarantee is another way we protect you from fraud loss. Our mobile and online banking is so secure that we'll cover any losses due to unauthorized use of your account, provided you notify us in a timely fashion when you notice any suspicious activity. Convenient banking features are right where you expect them to be. Simple, tabbed navigation, online bill pay, customizable financial tools and more.